Over the past few months I think the question I get asked most by other professionals, bloggers, and entrepreneurs is: how do you buy Bitcoin?

Starting your crypto portfolio is really not that difficult, but with the wealth of information out there, knowing where to begin can get a little confusing. Follow the simple steps in the short guide, and you’ll be on the fast-track to your first piece of the Bitcoin pie.

Buying Bitcoin Step 1: Open A Digital Wallet

Just like with fiat currency (USD in our case), it must be stored somewhere digitally, such as in an account. Bitcoin doesn’t usually work on an “account” basis, because technically speaking this is a banking term. We keep our money in the hands of other people, who manage our “accounts” for us. Bitcoin doesn’t work like that. Instead, it is kept in what is known as a digital “wallet” – basically a storage place online.

A digital wallet doesn’t have many features, like bank accounts typically do. Instead, it exists to serve two main purposes: to act as a place to store crypto, and to allow you to trade this crypto with other wallets. Auxiliary features do exist, such as various security features, but for the most part, Bitcoin wallets are simple. That’s one of the perks of Bitcoin actually. Their simplicity and lack of “banking red tape” is one of the reasons why Bitcoin and other forms of digital currency are becoming so popular all over the planet.

We’ll be opening a digital wallet on Coinbase, because it is also a trading platform as well as a wallet, and because it has a very low learning curve. Being as popular as it is, Coinbase also has some of the best support. Head on over to http://www.coinbase.com and start an account there. Note that in order to purchase Bitcoin, you will obviously need to link your Coinbase account with a bank account, and this process can take anywhere from a few hours to a few days depending on how busy the site is. You should get an email update once you are finally approved for transactions on Coinbase.

Buying Bitcoin Step 2: Get Familiar With The Market

Sure you might want to just grab some Bitcoin while you can, but it pays to take a look at the market and see what it’s going for on any given day. Bitcoin fluctuates frequently (but has an overall rocketing appreciation rate because it is exploding in value), so if you take 48 hours to keep an eye on it, you might be able to snag Bitcoin at a discounted price. The easiest way I’ve found to get an idea of what’s going on in the Cryptosphere is to head over to World Coin Index which makes viewing crypto fluctuations very easy.

If you happen to see Bitcoin 2% – 5% lower in 48 hours than the price you initially spotted it at, you should probably jump on it. Either way, studying how Bitcoin ebbs and flows will help you get acquainted with how it behaves and how you can eventually profit off of it. It also helps to follow Twitter accounts that share up-to-the-minute news about what’s happening with crypto. Since it is such a booming phenomena, you want info that is not stale. Bitcoin prices can change on a dime if news breaks about it, so it’s best to stay in the loop. Being informed is part of jumping into Bitcoin. It’s not like any other form of currency, banking, or investing.

Once you are comfortable with the price you are buying Bitcoin at, it’s time to take the leap!

Buying Bitcoin Step 3: Grabbing Your First Coins

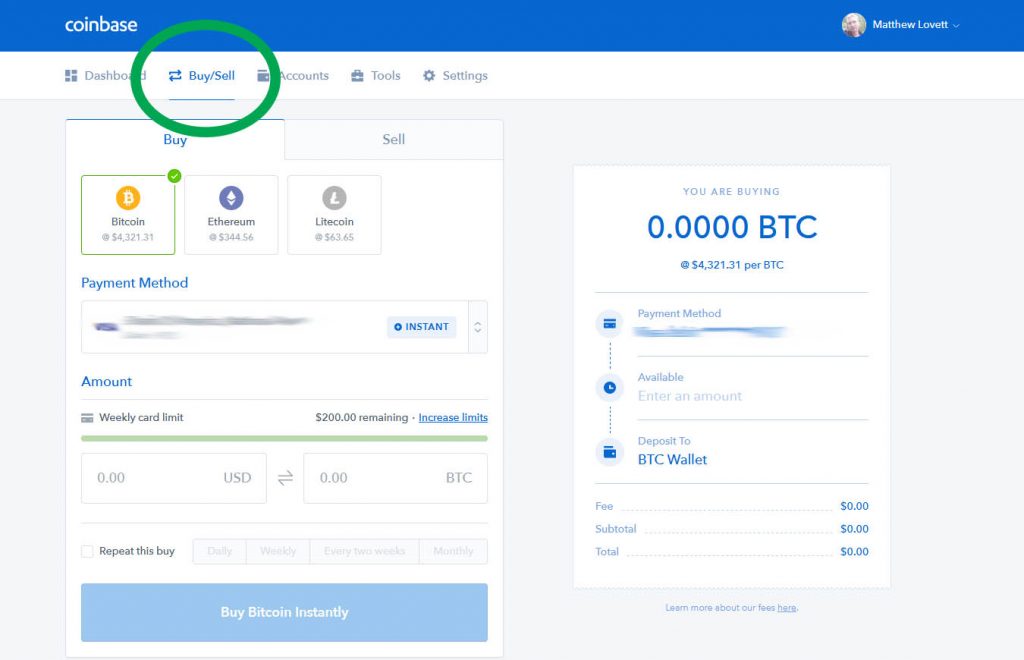

To initiate your first purchase of Bitcoin, all you have to do is log into your new Coinbase account, and once you are approved, head on over to the Buy/Sell tab. There, you will be able to choose which coin you want out of the three that are supported on Coinbase (Bitcoin, Ethereum, and Litecoin), and then decide on the amount you would like.

When you input a number into the leftside USD section, the corresponding amount will show up in BTC.

As of today, the price of one full Bitcoin is valued at over $16,000, so it’s unlikely you will be purchasing “1 BTC.” Instead, you will be purchasing fragments of one Bitcoin, called satoshi, which will be much smaller in dollar value. Don’t worry, it’s like cents are to dollars, satoshi aren’t worth less than whole Bitcoins. They are the same thing, just in smaller amounts.

When you are satisfied with the amount of Bitcoin you are purchasing (I would recommend starting off with $100 so you are not risking much but could still see potential gains as the coin increases in value), you will be able to just click the giant blue “Buy Bitcoin Instantly” button, and the transaction will go through if your bank / card credentials are correct. The time it takes to complete a Bitcoin transaction can vary, but don’t expect it to be literally “instant.” I’ve had a couple Bitcoin purchases that have taken hours. It all depends on the amount you choose and where you fall in the blockchain. Rest assured though, if you purchase the Bitcoin, you will get your desired amount before long. You will also receive email notifications when your transactions go through, so you don’t necessarily have to keep an eye on Coinbase.

It’s really that easy to buy your first Bitcoin. Once the transaction is complete, your digital wallet will be filled with the amount of Bitcoin you specified.

Building a Crypto Portfolio

You’re going to want to diversify once you really understand how crypto works. Investigating the myriad of altcoins, supporting their platforms and helping them grow is one of the perks of getting into the movement. There is a ton of innovation and competition driving it all, which means quality and value. The question is, which coins to support?

That is ultimately up to you and the research you perform. All three of the platforms offered on Coinbase are generally considered solid investments, for starters. You can purchase Ethereum and Litecoin the same exact way you purchase Bitcoin, and it will be stored on Coinbase in a separate digital wallet just for that coin. In order to purchase some of the other hundreds of altcoins, you’re going to need to open an account on one of the crypto exchanges, such as Bittrex. This is because you cannot normally purchase most altcoins with fiat currency, you have to purchase them with Bitcoin. So these transactions take place on am exchange, much in the same way stocks are traded.

The great part about altcoins is that some of them are still in their infancy, and some are also not valued high, so they are extremely cheap. Now, not all of them are projected to be worth more than what they are now, but with some research, you can uncover coins that have a great entry price yet are projected to gain value. Once you get comfortable with crypto, it’s not a bad idea to research a few cheap but promising altcoins and drop $50 to $100 worth of USD/BTC on them. What may cost 2 cents per coin now might be worth 4 or even 10 dollars a coin a year from now. Bam, you just made some decent money doing nothing but sitting on it. This is why crypto is being considered one of the most dynamic investment opportunities of our lifetimes. Fortunes are being made overnight – but don’t expect crazy returns all the time.

My advice for anyone first stepping foot into portfolio-building, research about 5 alts that you like for various reasons. Maybe the industry appeals to you, maybe you like their team, or their staff, or what they promise to do in the future. Maybe you like their projections. Whatever the case may be, out of those 5, make sure two of them are coins that cost less than a quarter a piece. In other words, aim for around .10 to .25 cents or so, and then put a solid amount of money on them I would sit on these and see where they go. No sense day trading them even if they peak, because at the end of the day if you want to buy back into them, you’ll be buying back at a higher price. Avoid all that and treat crypto like a real investment, with the aim being the accumulation of Bitcoin.

Follow these guidelines and you’ll have the framework for a rockin’ portfolio. Expanding it will depend on how much research you want to do into the market and how much expendable income you have to invest (remember: never invest into crypto what you can’t afford to lose). Your central focus should be Bitcoin however. It is the most widely known cryptocurrency, has the most baking, and is projected to be extremely valuable even past what it currently is. This means that one Bitcoin could easily be worth $50,000 a piece at some point, or even higher. That means get in early and stay in!

Last word of advice: don’t give into fear if you ever see Bitcoin dip or drop. Especially right now, as Bitcoin is experiencing a period of exponential growth, which is bound to face a market correction at some point. It could even double its value right now and stay high well into next year, but a correction is likely. This doesn’t mean it is “crashing” – stocks and crypto are two different things, and are governed by two sets of parameters for determining their worth. Whenever Bitcoin faces dips in value, it always recuperates and then explodes past what its previous peaks were, this is because all over the world, demand for it is rising, and its intrinsic scarcity and value is increasing. Market corrections in crypto are healthy, so don’t bail on a dip. You’ll regret it immensely.

Want more info about crypto investing? Follow me on Twitter!